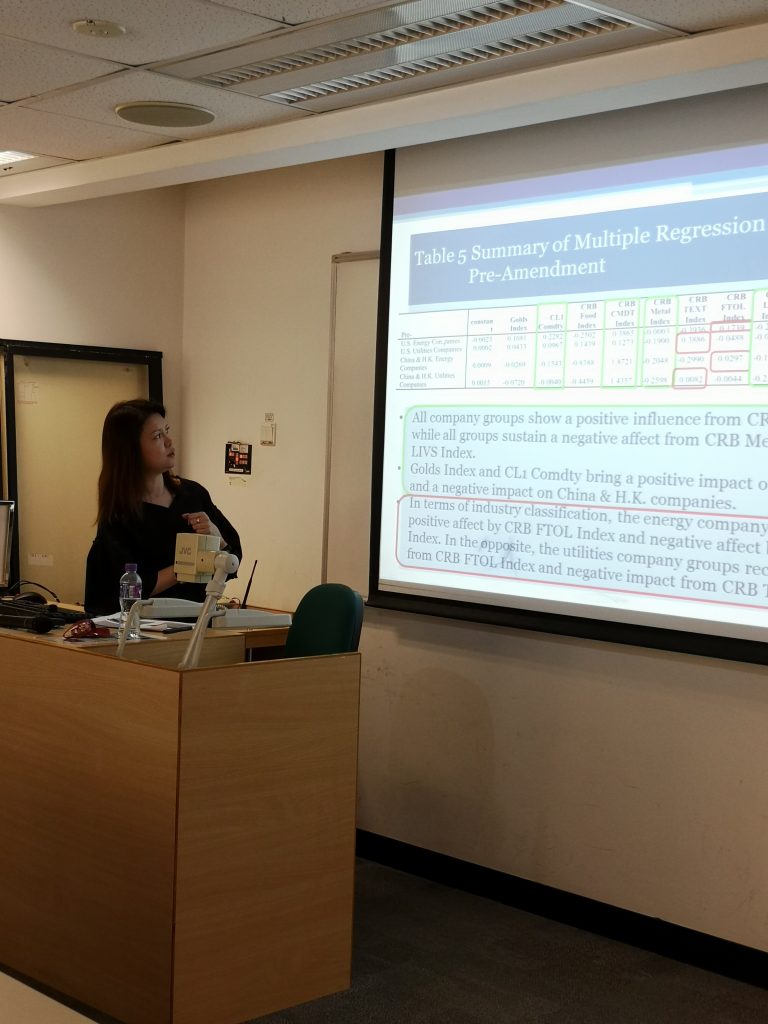

In this seminar, price and volatility sensitivity of utility and energy stocks in the commodity markets were examined. The authors first examine how environmental regulations, such as the Paris Agreement, affect the stock markets. Second, how companies in Western and Eastern countries reacted after the Doha Amendment was adopted by their governments were evaluated. Finally, the authors presented multiple regressions and conducted a Markov switching model in an event study. The findings show consistent company performances within the same industry group. The energy market has various effects on particular industry companies. US companies that are presumed to be well developed change the most in response to changes in energy regulations. All of these observations depend on which commodity price is applied.

Based upon Balu's (1964) social exchange theory, this study examined the effects of leaders' coaching style on followers' organizational citizenship behavior (OCB) thought idiosyncratic deals (i-deals). Specifically, the authors explored 3 types of i-deals, namely task i-deals, work schedule i-deals, and financial incentive i-deals, as mediators of the relationships between two coaching styles (i.e., guidance and facilitation coaching) and two facets of OCB, interpersonal OCB (OCB-I) and organizational OCB (OCB-O). A field study with 219 employees and 60 immediate supervisors was conducted. The results of structural equation modelling (SEM) showed that two coaching styles were significantly related to i-deals, but in opposite directions. Moreover, there were contrasting effects of i-deals on OCB-I and OCB-O. Mediating roles of i-deals were also examined.

This study examines the performance implications of guanxi-related perk expenditures among listed Chinese firms. Specifically, it investigates how these expenditures influence long-term market-based corporate performance (Tobin's Q and market share) as compared with marketing expenditures. It also examines if political connections moderate this influence. Overall, the findings suggest that guanxi-related perks play an essential marketing role in enhancing long-term corporate success. Furthermore, although marketing expenditures exert much stronger influence on Tobin's Q than guanxi-related perks do, they exert no significant influence on market share. In summary, despite firms' much heavier investments in traditional marketing activities than guanxi-related perk activities, the findings highlight the significant performance contribution that guanxi-related perks can still make to a firm. Moreover, this study reveals that political connections weaken the positive impact of guanxi-related perks on both performance measures, thus reminding executives of the dampening effect of these connections on the effective use of perk spending.

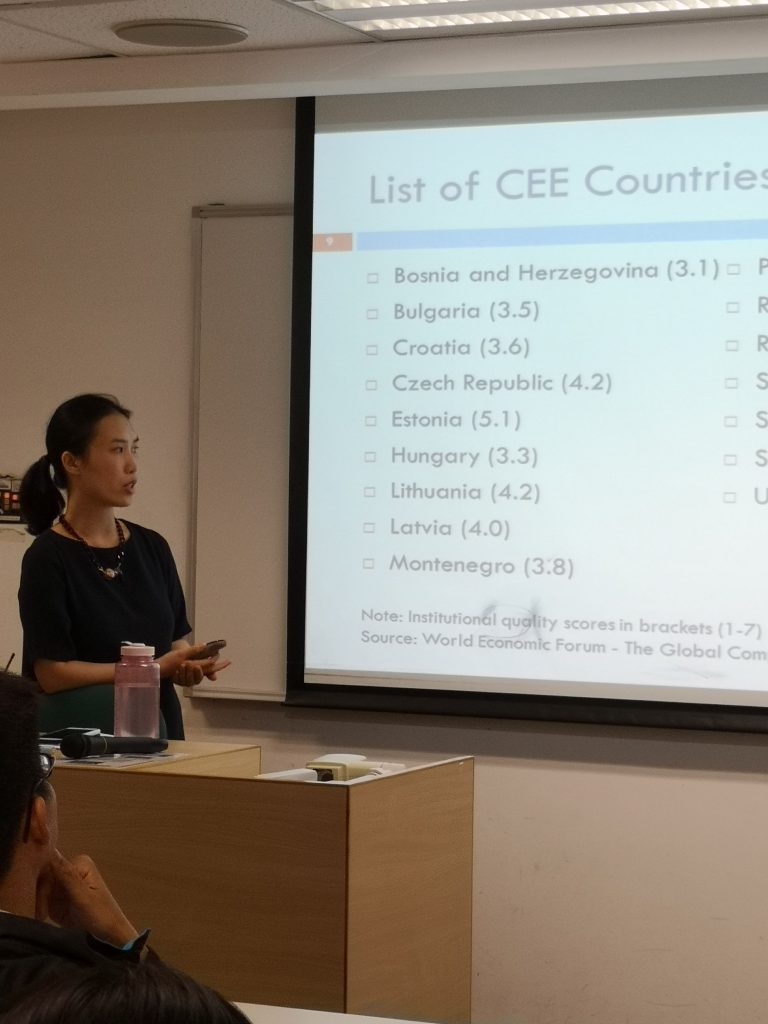

Although it is known that the institutional transformation in transition economies varies, it is unclear how such variations influence firm performance. In the paper presented in this seminar, the authors examine how cross-country variations in institutional development in Central and Eastern Europe (CEE) affect firm profitability. This paper contributes to IB research on the role of institutions by demonstrating that the benefits of having a more developed institutional environment differs significantly across firms depending on the nature of the industry in which firms operate. Based on a sample of over 64,000 observations in 16 CEE countries, the analysis shows that institutional reforms are particularly beneficial in industries characterized by high levels of technological dynamism, but conversely their value is limited in industries that exhibit lower levels of technological dynamism. By contrast, higher levels of market dynamism within an industry motivate firms to internalize more functions. As a result, a completely opposite pattern of results is observed in such industries where the role of institutions becomes less positive.